Everyday time-compression works by using - this decides how AmiBroker performs intraday to every day time compression

This state typically necessitates some user intervention which include checking/fixing user/password in File->Database Configurations->Configure or managing needed component. Any time you take care of The main reason the plugin will immediately try and reconnect (and when reconnect is successfull then "Okay" will be displayed)

Precision of data – The datafeed should provide precise data that may be employed for live trading in addition to backtesting

Every trader ought to make use of these AFL scripts, but they must be familiar with their limitations ahead of utilizing them in buying and selling. Prior to deciding to subscribe, obtain a no cost demo for Amibroker data feed from Amiprofits.

An ideal Amibroker data feed may differ Using the trading technique, knowledge, and funds that you've got. Here are some components to think about:

In this instance freshly imported symbols are marked by ASCII importer as "use only regional database for this symbol" (See Facts window for specifics), so They're EXCLUDED from the actual-time update. This is useful if you want to import Several other data (even not quote data) and obtain it by way of Overseas perform though utilizing your real-time database.

By way of example, if you need to go very long on a certain candlestick, be sure the trade volume is huge, the price is inside of Bollinger bands, as well as MACD line favors your trade. How are you going to discover the inventory that tends to all of these?

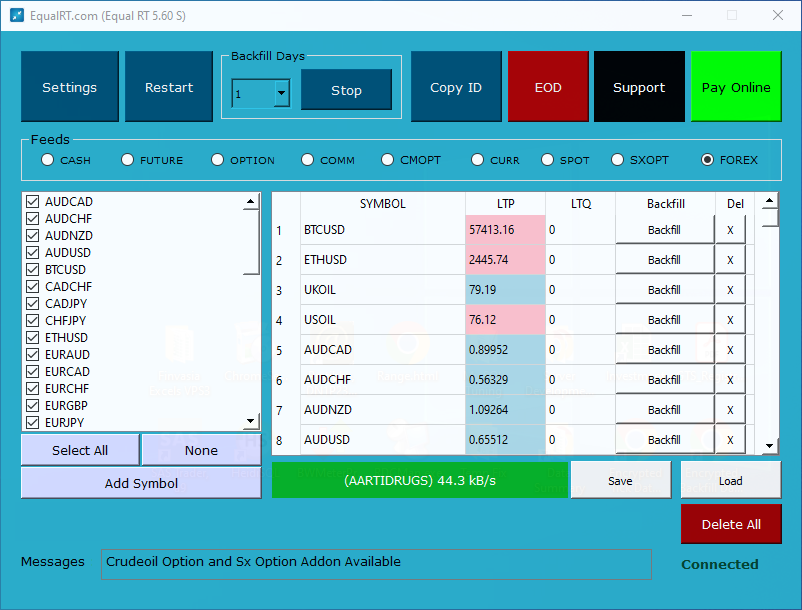

Data Backfill: In case you need to shut down your Computer system for the duration of industry hours, NimbleDataPro can mechanically backfill the missing data in a handful of seconds.

Accuracy of data – The datafeed must give precise data that could be employed for Stay buying and selling together with backtesting

Fibonacci Bands by Bollinger AFL determine the breakout concentrations determined by stock volatility. It can help traders determine if the worth is previously mentioned or below the acute marks.

Nevertheless, when trading manually, traders could only find and trade in a restricted range of stocks.

cleaning up terrible ticks (whenever you see a nasty tick it's possible you'll try out forcing backfill in hope that data seller has cleaned up its database and you may get set data - performs perfectly for eSignal that really appears to repair lousy ticks when they occur)

Allow for blended EOD/Intraday data - it enables to work with database which has a combination of intraday and EOD data in a single data file. If This really is turned on then in intraday modes EOD bars are eradicated on-the-fly and in every day mode EOD bars are displayed as an alternative to time compressed intraday or if there isn't a EOD bar for corresponding working day more info then intraday bars are compressed as standard.

By way of example if you utilize TC2000 to be a data source all data which are current in TC2000 technique come to be immediately obtainable in AmiBroker. For additional facts please study Tutorial: Knowing database ideas.

Combining distinctive investing alerts, charts, and indicators normally allows traders minimize hazard and assemble much better investing tactics.